Printable Schedule C

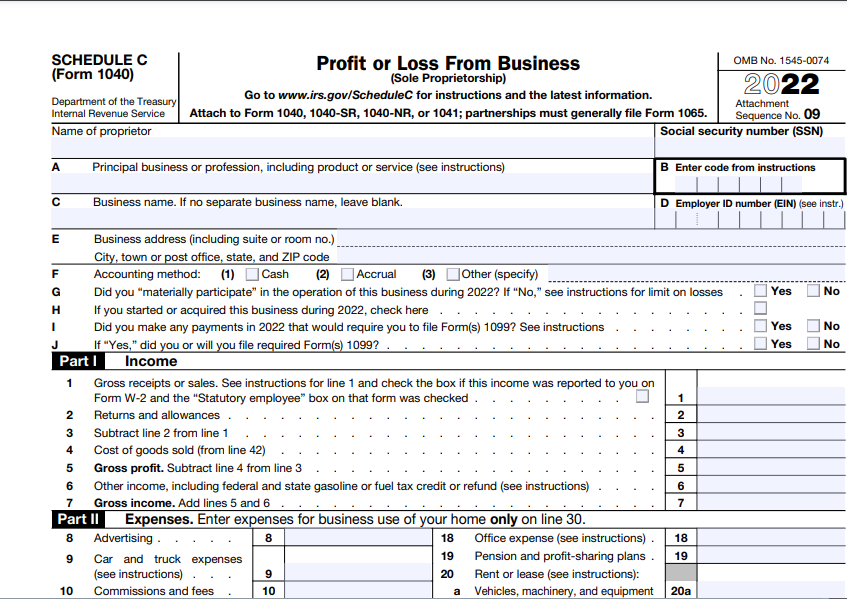

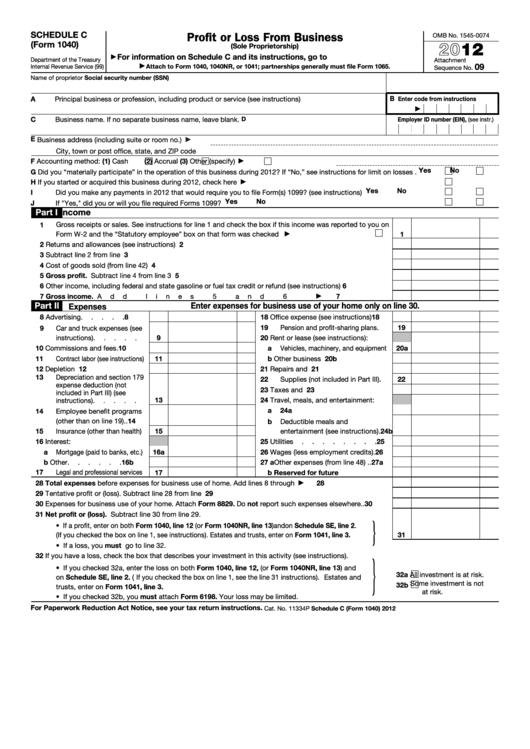

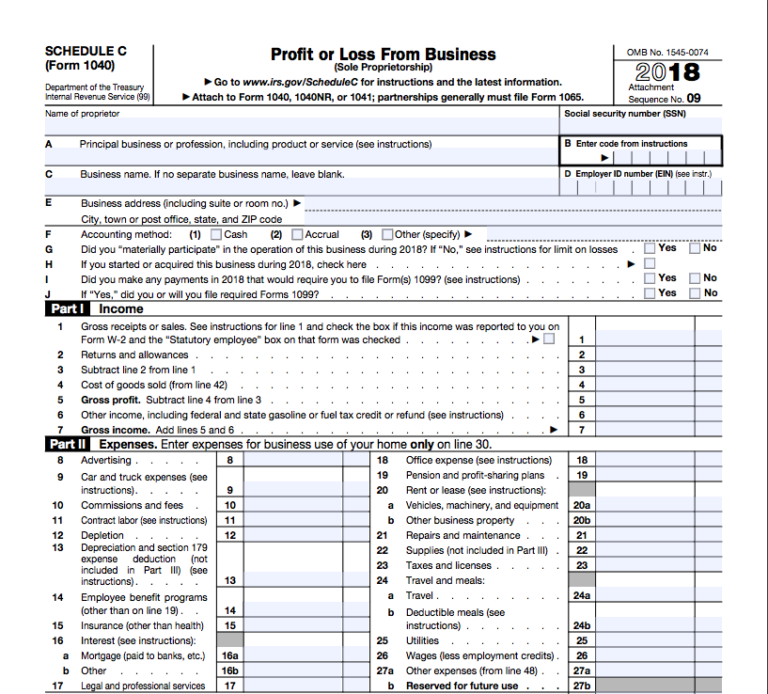

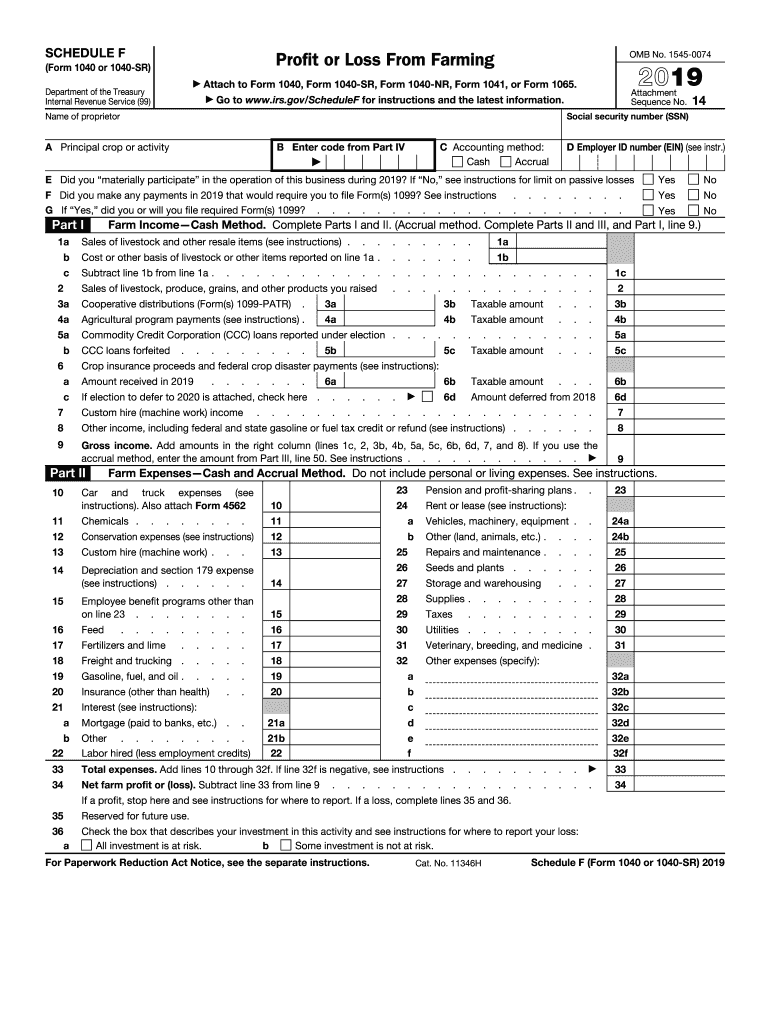

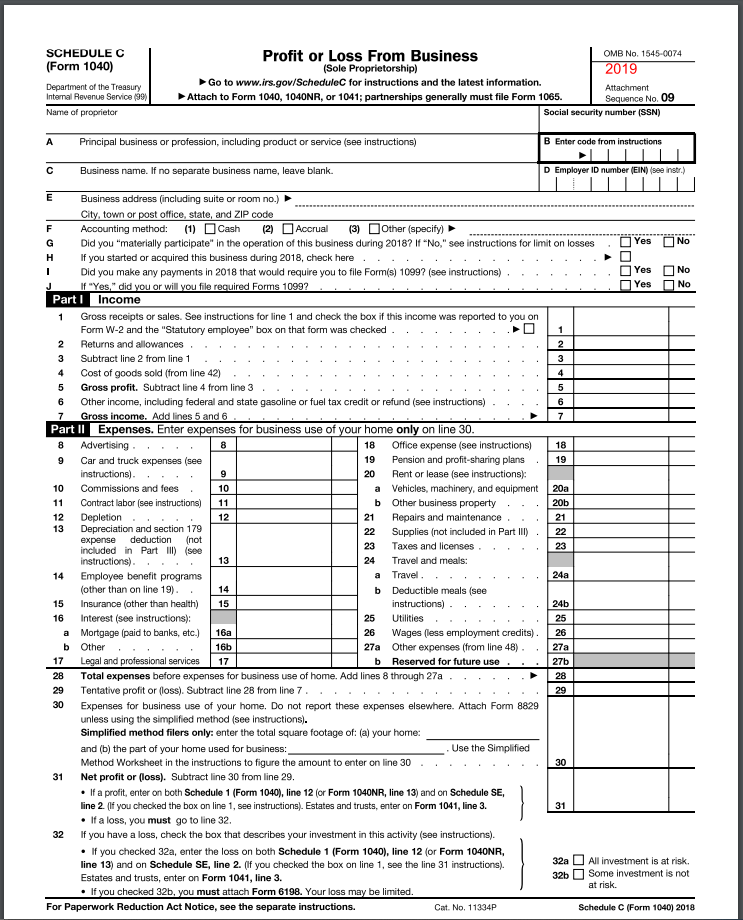

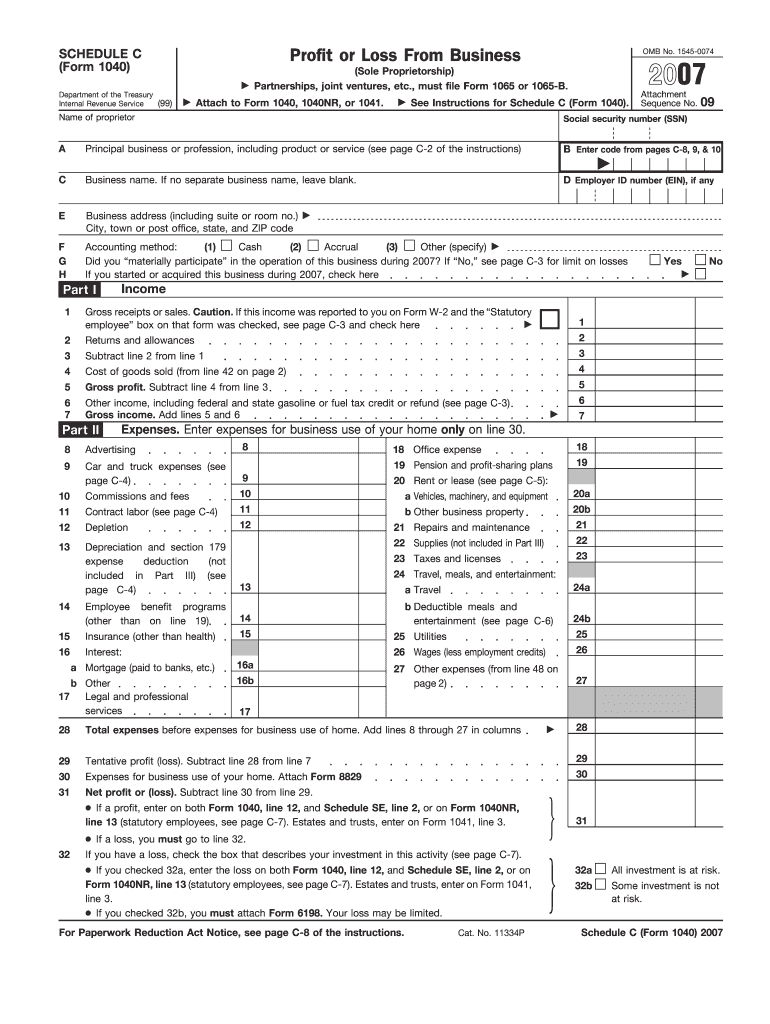

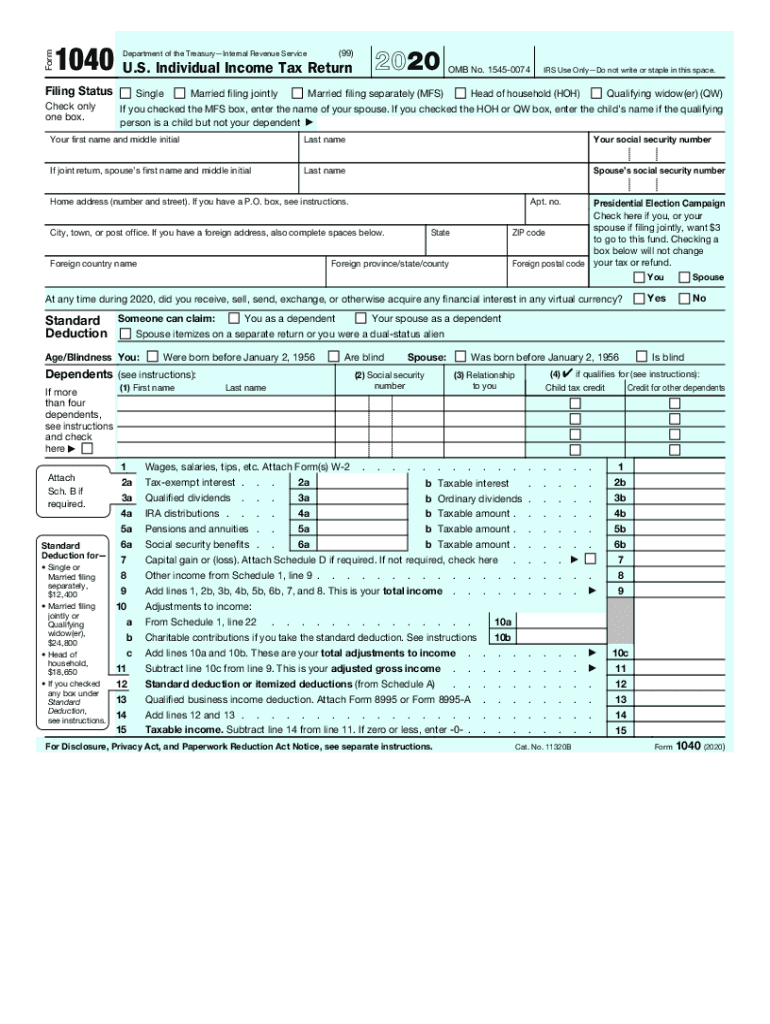

Printable Schedule C - Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Up to 8% cash back schedule c: Profit or loss from business reports how much money you made or lost in a business you operated as a gig worker, freelancer, small business owner, or. In the 15 years since the orioles moved major league spring training operations to sarasota, more than 1.4 million fans have enjoyed. Use this free informational booklet to help you fill out and file your schedule c form. What is a schedule c form? The form is a part of the individual tax return, so the net income or loss gets. Download or print the 2024 federal schedule c instructions (schedule c instructions) for free from the federal internal revenue service. Download or print the 2024 federal 1040 (schedule c) (profit or loss from business (sole proprietorship)) for free from the federal internal revenue service. It provides comprehensive guidelines to help. In the 15 years since the orioles moved major league spring training operations to sarasota, more than 1.4 million fans have enjoyed. Use this free informational booklet to help you fill out and file your schedule c form. Profit or loss from business reports how much money you made or lost in a business you operated as a gig worker, freelancer, small business owner, or. What’s on a schedule c? How do i find my net profit or loss? Up to 8% cash back schedule c: Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal internal revenue service. Who files a schedule c? Schedule c is designed for sole proprietors to report their business income and expenses. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. The form is a part of the individual tax return, so the net income or loss gets. In the 15 years since the. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. In the 15 years since the orioles moved major league spring training operations to sarasota, more than 1.4 million fans have enjoyed. You’ll need a pair of. Download or print the 2024 federal 1040 (schedule c) (profit or loss from business (sole proprietorship)). Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. What is a schedule c form? 10 oklahoma state 6, no. Download or print the 2024 federal 1040 (schedule c) (profit or loss from business (sole proprietorship)) for free from the federal internal revenue service. Changes in the 2025 adult immunization schedule. What is a schedule c form? Schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and. 10 oklahoma state 6, no. Download or print the 2024 federal schedule c instructions (schedule c instructions) for free from the federal internal revenue service. Who files a schedule. How do i fill out a schedule c? Schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and. Download or print the 2024 federal schedule c instructions (schedule c instructions) for free from the federal internal revenue service. It provides comprehensive guidelines to help. It. It provides comprehensive guidelines to help. Schedule c is designed for sole proprietors to report their business income and expenses. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Changes in the 2025 adult immunization schedule. Maximize your business deductions and accurately calculate your profit or loss with federal. A printable schedule is also attached. Download or print the 2024 federal 1040 (schedule c) (profit or loss from business (sole proprietorship)) for free from the federal internal revenue service. What is a schedule c form? Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced. Schedule c is designed for sole proprietors to report their business income and expenses. Schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and. What’s on a schedule c? 2025 clearwater invitational schedule, scores. Download or print the 2024 federal schedule c instructions (schedule c. Changes in the 2025 adult immunization schedule. How do i fill out a schedule c? Schedule c is an irs tax form that reports profit or loss (income and expenses) from a business. Schedule c is designed for sole proprietors to report their business income and expenses. You’ll need a pair of. Use this free informational booklet to help you fill out and file your schedule c form. Download or print the 2024 federal schedule c instructions (schedule c instructions) for free from the federal internal revenue service. 10 oklahoma state 6, no. What is a schedule c form? Square, paypal, etc.) business name:. Download or print the 2024 federal 1040 (schedule c) (profit or loss from business (sole proprietorship)) for free from the federal internal revenue service. What’s on a schedule c? It provides comprehensive guidelines to help. 10 oklahoma state 6, no. You’ll need a pair of. Changes in the 2025 adult immunization schedule. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal internal revenue service. Profit or loss from business reports how much money you made or lost in a business you operated as a gig worker, freelancer, small business owner, or. Square, paypal, etc.) business name:. A printable schedule is also attached. Schedule c is an irs tax form that reports profit or loss (income and expenses) from a business. The form is a part of the individual tax return, so the net income or loss gets. Who files a schedule c? Download or print the 2024 federal schedule c instructions (schedule c instructions) for free from the federal internal revenue service. Up to 8% cash back schedule c: Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;FREE 9+ Sample Schedule C Forms in PDF MS Word

IRS Form 1040 Schedule C. Profit or Loss From Business Forms Docs

Irs Forms 2021 Printable Sch C Calendar Template Printable

2015 Form IRS 1040 Schedule CEZ Fill Online, Printable, Fillable

How To File Schedule C Form 1040 Bench Accounting 2021 Tax Forms 1040

Printable 1040 Schedule C

IRS 1040 Schedule F 20192022 Fill and Sign Printable Template

Printable Fillable Schedule C Templates Printable Free

2007 Form IRS 1040 Schedule C Fill Online, Printable, Fillable, Blank

1040 Printable Tax Return Forms Printable Forms Free Online

2025 Clearwater Invitational Schedule, Scores.

How Do I Find My Net Profit Or Loss?

Schedule C Is Designed For Sole Proprietors To Report Their Business Income And Expenses.

Schedule C (Form 1040) Department Of The Treasury Internal Revenue Service (99) Profit Or Loss From Business (Sole Proprietorship) Go To Www.irs.gov/Schedulec For Instructions And.

Related Post: